Table of Contents

Mortgage Calculator: PMI, Interest, Taxes and Insurance 2024

Mortgage Calculator: PMI, Interest, Taxes and Insurance 2024. mortgage calculator, mortgage repayment calculator, mortgage calculator repayment, mortgage calculator uk, mortgage loan calculator, td mortgage calculator, mortgage affordability calculator, mortgage calculator canada, mortgage calculator amortization, mortgage calculator zillow, zillow mortgage calculator, mortgage payoff calculator, mortgage overpayment calculator, halifax mortgage calculator, mortgage interest calculator, mortgage calculator nationwide, home mortgage calculator, rbc mortgage calculator, nationwide mortgage calculator, mortgage calculator bc, mortgage calculator with taxes, natwest mortgage calculator, anz mortgage calculator, mortgage calculator nz, hsbc mortgage calculator, cibc mortgage calculator. A mortgage calculator is a useful tool that helps you calculate your monthly mortgage payments based on the loan amount, interest rate, and other relevant factors. Here’s a basic formula to calculate your monthly mortgage payments:

Monthly Payment = Loan Amount x (Interest Rate / 12) / (1 – (1 + Interest Rate / 12) ^ (-Number of Months))

Here are the steps to use the mortgage calculator:

- Enter the loan amount you wish to borrow.

- Enter the interest rate for the loan.

- Enter the term or number of months for the loan.

- Press the calculate button to determine your monthly payment.

Alternatively, you can also use online mortgage calculators available on various websites, including bank websites, mortgage companies, and financial websites.

By using a mortgage calculator, you can get a good estimate of your monthly payments, and you can use this information to compare different loan options and choose the best one that suits your budget and needs.

Benefits of Mortgage Calculator

One of the biggest financial decisions you’ll make in your lifetime is buying a home. While it’s an exciting process, it can also be overwhelming, especially when it comes to the finances involved. That’s where a mortgage calculator comes in handy.

A mortgage calculator is a simple online tool that helps you estimate your monthly mortgage payments based on different variables, such as the loan amount, interest rate, and term. It can help you make informed decisions about your home financing and avoid any surprises when it comes to your monthly payments.

Here are some of the benefits of using a mortgage calculator:

1. It Helps You Plan Your Budget

A mortgage calculator can help you determine the monthly payments you can afford based on your income and expenses. By entering different variables, such as the loan amount, interest rate, and term, you can see how different scenarios will affect your monthly payments. This information can help you plan your budget and ensure that you’re not overextending yourself financially.

2. It Helps You Compare Different Loan Options

A mortgage calculator can help you compare different loan options and their associated costs. By entering the interest rate and term for each loan option, you can see how much your monthly payments would be for each scenario. This can help you choose the best loan option that suits your budget and needs.

DO NOT MISS: List of Best PDF Editors for Windows 2023

3. It Helps You Estimate Your Total Cost of Homeownership

A mortgage calculator can also help you estimate your total cost of homeownership over the life of your mortgage. By entering the loan amount, interest rate, and term, you can see how much you’ll pay in total interest over the life of the loan. This information can help you plan for the long term and make informed decisions about your home financing.

Simple Mortgage Calculator

A simple mortgage calculator is a tool that helps you calculate your monthly mortgage payment based on various inputs like loan amount, interest rate, and loan term. It is a handy tool that can help you estimate your monthly payments and plan your budget accordingly.

To use a simple mortgage calculator, you need to enter the loan amount, interest rate, and loan term. Some calculators may also ask you to enter the down payment and property taxes. Once you enter all the required information, the calculator will give you an estimate of your monthly payment.

Here is an example of how to use a simple mortgage calculator:

- Enter the loan amount: Suppose you are looking to buy a house that costs $250,000.

- Enter the interest rate: Let’s assume the interest rate is 3%.

- Enter the loan term: Suppose you are taking a 30-year loan.

- Enter the down payment: If you are putting 20% down, your down payment would be $50,000.

- Enter the property taxes: If the property taxes are $3,000 per year, your monthly payment would include an additional $250 in taxes.

- Click on the calculate button: The calculator will show you an estimated monthly payment of $898.09.

Google Mortgage Calculator

Google does not have a built-in mortgage calculator, but you can use the search engine to find and use online mortgage calculators from various websites. Here are the steps to find a mortgage calculator using Google:

- Open the Google search engine on your web browser.

- Type “mortgage calculator” in the search bar and hit enter.

- You will see a list of websites that offer free online mortgage calculators. Click on the one that you prefer.

- Once you are on the mortgage calculator page, enter the necessary information such as loan amount, interest rate, term, and other relevant details.

- Click on the “calculate” button and the calculator will generate the monthly mortgage payment, total interest, and other relevant information.

Keep in mind that different mortgage calculators may have different features and functions, so it’s important to choose a reliable and accurate calculator to get an estimate of your mortgage payment.

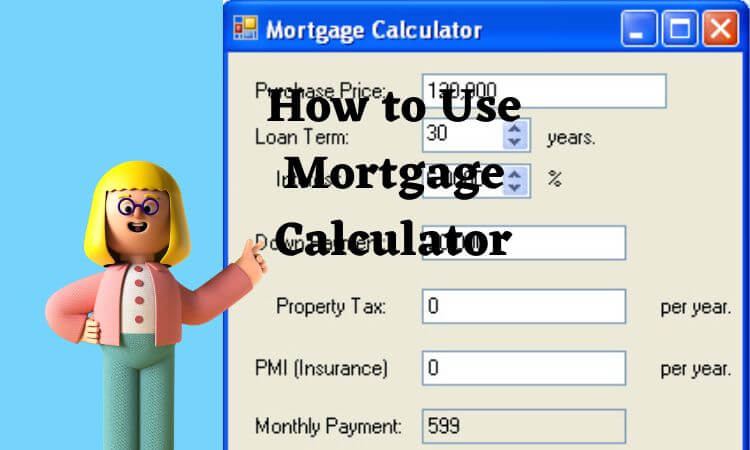

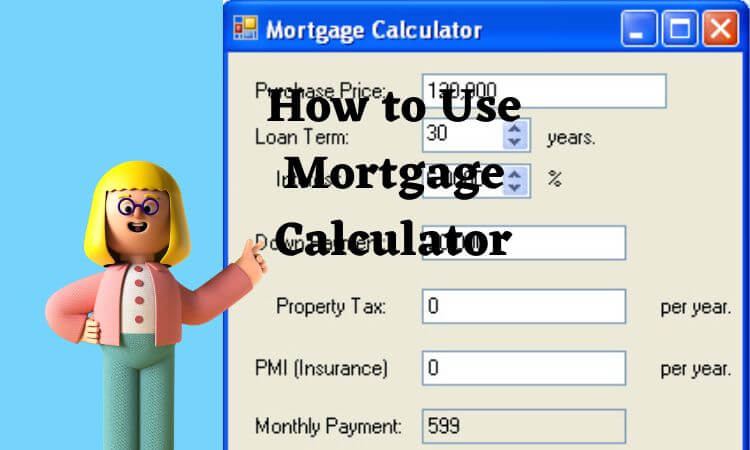

How to Use a Mortgage Calculator

Using a mortgage calculator is relatively straightforward. Here are the general steps to use a mortgage calculator:

- Find a mortgage calculator online. You can find a mortgage calculator on various websites, including bank websites, mortgage companies, and financial websites.

- Enter the loan amount you wish to borrow. This is the total amount you plan to borrow to purchase your home.

- Enter the interest rate for the loan. The interest rate is the percentage of the loan amount that the lender charges you for borrowing the money.

- Enter the term or number of months for the loan. This is the length of time you plan to take to repay your loan.

- Enter any other relevant information, such as your down payment, taxes, and insurance.

- Click on the “calculate” button to determine your monthly payment.

Once you have entered all the necessary information, the mortgage calculator will display your estimated monthly payment, as well as the total amount of interest you will pay over the life of the loan.

By using a mortgage calculator, you can get a good estimate of your monthly payments, and you can use this information to compare different loan options and choose the best one that suits your budget and needs.

Mortgage Calculator Payment

A mortgage calculator payment tool is an online calculator that helps you calculate your monthly mortgage payment based on the loan amount, interest rate, and other factors. It can help you estimate how much you will need to pay each month towards your mortgage, including principal and interest.

To use a mortgage calculator payment tool, you will need to input the following information:

- Loan amount: The total amount of money you are borrowing.

- Interest rate: The annual interest rate you will pay on the loan.

- Loan term: The length of the loan in years.

- Payment frequency: How often you will make payments (e.g. monthly, bi-weekly, weekly).

- Start date: The date you will start making payments.

- Other costs: Any additional costs, such as property taxes, home insurance, or mortgage insurance.

Once you input this information, the mortgage calculator will calculate your monthly payment, as well as the total amount of interest you will pay over the life of the loan.

Using a mortgage calculator payment tool can be helpful when you are trying to determine how much you can afford to borrow, or if you are trying to compare different loan options to find the best one for you. It can also help you understand how different factors, such as interest rates or payment frequency, can affect your monthly payment.

It is important to note that while a mortgage calculator payment tool can provide a useful estimate, it is not a substitute for professional financial advice. Before making any major financial decisions, it is always a good idea to consult with a financial advisor or mortgage broker who can provide personalized advice based on your specific financial situation.

Mortgage Calculator Repayment

A mortgage calculator is an online tool that helps borrowers estimate their monthly mortgage payments. The tool takes into account the loan amount, interest rate, term of the loan, and other factors to provide an estimate of the monthly payment.

One of the most common types of mortgage calculators is the repayment calculator. This tool allows borrowers to estimate their monthly mortgage payments based on the loan amount, interest rate, and term of the loan. Repayment calculators take into account the principal and interest payments, as well as any taxes and insurance that may be included in the monthly payment.

To use a mortgage repayment calculator, borrowers will need to enter the loan amount, interest rate, and term of the loan. They may also need to enter information about their down payment, taxes, and insurance. Once all of this information has been entered, the calculator will provide an estimate of the monthly mortgage payment.

It’s important to note that mortgage calculators are only estimates and do not take into account other factors that may affect the actual monthly payment. For example, the actual interest rate may be different from the estimated rate, and taxes and insurance costs may vary. Borrowers should use mortgage calculators as a starting point and speak with a lender to get a more accurate estimate of their monthly mortgage payment.

Mortgage Calculator Amortization

A mortgage calculator with an amortization schedule is a powerful tool for understanding the costs of a mortgage over time. With an amortization schedule, you can see exactly how much of each mortgage payment goes toward the principal and how much goes toward interest. This information can be extremely useful in helping you plan your mortgage payments and budget.

To use a mortgage calculator with an amortization schedule, you’ll need to input some basic information about your mortgage, including the loan amount, interest rate, loan term, and payment frequency. The calculator will then calculate your monthly mortgage payment, as well as how much of each payment goes toward principal and interest.

Once you have this information, you can use the amortization schedule to see how your mortgage payments will change over time. The schedule will show you exactly how much of each payment goes toward principal and interest, as well as how much principal you will have paid off at the end of each year.

This information can be particularly useful if you’re considering making extra payments on your mortgage to pay it off more quickly. By looking at the amortization schedule, you can see exactly how much of your payment goes toward principal each month and how much goes toward interest. This can help you decide whether making extra payments is the right choice for you.

Another way to use a mortgage calculator with an amortization schedule is to compare different mortgage options. For example, you could input information for two different mortgage offers to see how the monthly payments and amortization schedules compare. This can help you make an informed decision about which mortgage offer is right for you.

Mortgage Loan Calculator

A mortgage loan calculator is a useful tool for anyone who is considering taking out a mortgage to purchase a home. With a mortgage loan calculator, you can input some basic information about your mortgage, including the loan amount, interest rate, loan term, and payment frequency, and the calculator will provide you with information about your monthly mortgage payment, as well as other important details about your mortgage.

To use a mortgage loan calculator, you’ll need to input information about your mortgage, such as the loan amount, interest rate, loan term, and payment frequency. Once you’ve input this information, the calculator will use an algorithm to determine your monthly mortgage payment.

In addition to your monthly mortgage payment, a mortgage loan calculator can provide you with other useful information about your mortgage, such as the total amount of interest you’ll pay over the life of the loan, the total cost of the loan, and the amortization schedule.

The amortization schedule is particularly useful, as it provides you with a detailed breakdown of each payment over the life of the loan. This schedule shows you how much of each payment goes toward interest and how much goes toward paying down the principal. This information can be incredibly helpful in planning your budget and determining how much you can afford to pay each month.

A mortgage loan calculator can also be used to compare different mortgage options. For example, you could input information for two different mortgage offers to see how the monthly payments and other details compare. This can help you make an informed decision about which mortgage offer is right for you.

Zillow Mortgage Calculator

Zillow is a popular online real estate company that offers a variety of tools and resources for home buyers and sellers, including a mortgage calculator. The Zillow mortgage calculator is a free online tool that helps you estimate your monthly mortgage payments and provides you with other important details about your mortgage.

To use the Zillow mortgage calculator, you’ll need to input some basic information about your mortgage, including the loan amount, interest rate, loan term, and payment frequency. You’ll also need to provide information about your down payment and any other fees or charges associated with your mortgage, such as closing costs.

Once you’ve input this information, the Zillow mortgage calculator will provide you with an estimate of your monthly mortgage payment, as well as other important details about your mortgage, such as the total amount of interest you’ll pay over the life of the loan, the total cost of the loan, and the amortization schedule.

One of the unique features of the Zillow mortgage calculator is that it also allows you to input information about property taxes and homeowner’s insurance, which can be included in your monthly mortgage payment. This can be helpful in estimating your total monthly housing costs.

Another useful feature of the Zillow mortgage calculator is that it allows you to compare different mortgage options. For example, you can input information for two different mortgage offers to see how the monthly payments and other details compare. This can help you make an informed decision about which mortgage offer is right for you.

RBC Mortgage Calculator

RBC (Royal Bank of Canada) offers a mortgage calculator on their website to help customers estimate their monthly mortgage payments and determine their affordability. The RBC mortgage calculator is an easy-to-use tool that provides instant results based on the information provided by the user.

To use the RBC mortgage calculator, you will need to input some basic information, including the purchase price of the home, the amount of your down payment, the interest rate, and the amortization period (the length of the mortgage). You can also select different payment frequencies, such as weekly or biweekly, to see how it affects your payment amounts.

The RBC mortgage calculator also offers additional features that allow you to adjust other variables, such as property taxes and home insurance, to get a more accurate estimate of your monthly payments. You can also choose to include mortgage insurance premiums if applicable.

One useful feature of the RBC mortgage calculator is that it provides a breakdown of your payment, showing you how much of your payment goes towards the principal and interest, as well as other costs such as property taxes and insurance. It also shows you the total amount of interest you will pay over the life of the mortgage.

The RBC mortgage calculator is also helpful for comparing different mortgage options. You can input different interest rates or mortgage terms to see how they affect your monthly payments and the total cost of the mortgage. This can help you make an informed decision about which mortgage is right for you.

Halifax Mortgage Calculator

The Halifax mortgage calculator is a tool designed to help people estimate their monthly mortgage payments and the total cost of their mortgage. The calculator is available on the Halifax website and is free to use.

To use the Halifax mortgage calculator, you will need to input some basic information about your mortgage, including the purchase price of the property, the amount of your down payment, the interest rate, and the length of your mortgage. The calculator will then use this information to calculate your monthly mortgage payments and the total cost of your mortgage over its term.

One useful feature of the Halifax mortgage calculator is that it allows you to see how different mortgage terms and interest rates can affect your monthly payments and the total cost of your mortgage. You can experiment with different scenarios by adjusting the mortgage term, the interest rate, or the amount of your down payment to see how they impact your payments.

The Halifax mortgage calculator also provides a breakdown of your monthly payments, showing you how much of your payment goes towards the principal, interest, and any other costs such as property taxes and insurance. This can be helpful in understanding the costs associated with owning a home and budgeting for your monthly expenses.

Nationwide Mortgage Calculator

The Nationwide mortgage calculator is a tool designed to help people estimate their monthly mortgage payments and the total cost of their mortgage. It is available on the Nationwide Building Society website and is free to use.

To use the Nationwide mortgage calculator, you will need to input some basic information about your mortgage, including the purchase price of the property, the amount of your deposit, the interest rate, and the length of your mortgage. The calculator will then use this information to calculate your monthly mortgage payments and the total cost of your mortgage over its term.

One useful feature of the Nationwide mortgage calculator is that it allows you to see how different mortgage terms and interest rates can affect your monthly payments and the total cost of your mortgage. You can experiment with different scenarios by adjusting the mortgage term, the interest rate, or the amount of your deposit to see how they impact your payments.

The Nationwide mortgage calculator also provides a breakdown of your monthly payments, showing you how much of your payment goes towards the principal, interest, and any other costs such as property taxes and insurance. This can be helpful in understanding the costs associated with owning a home and budgeting for your monthly expenses.

In addition to the basic mortgage calculator, the Nationwide website also offers a range of other tools and resources to help you with your mortgage, including guides to buying a home, mortgage calculators for specific types of mortgages, and information on the mortgage application process.

Mortgage Calculator BC

A mortgage calculator can be a useful tool when you are considering buying a home in British Columbia (BC). The calculator can help you estimate your monthly mortgage payments based on the purchase price of the property, your down payment, the interest rate, and the length of the mortgage term.

There are many mortgage calculators available online that you can use to estimate your mortgage payments in BC. Most of these calculators work in the same way. You input the information about the mortgage, and the calculator provides you with an estimate of your monthly payments. Some calculators may also provide you with additional information, such as the total cost of the mortgage or the amortization schedule.

When using a mortgage calculator, it is essential to remember that the estimated monthly payments are just that – estimates. Your actual mortgage payments may be different depending on a range of factors, such as your credit score, income, and other debts. It is also important to remember that there are other costs associated with buying a home in BC, such as property taxes, home insurance, and closing costs.

To find a mortgage calculator specific to BC, you can search online for “mortgage calculator BC.” Many banks and mortgage lenders also provide mortgage calculators on their websites, which can be helpful if you are considering getting a mortgage from them. Some of the major banks and mortgage lenders in BC include RBC, TD, CIBC, Scotiabank, and BMO.

Mortgage Calculator with Taxes

A mortgage calculator with taxes is a useful tool that helps homeowners estimate the monthly payments for their mortgage, including property taxes. A mortgage calculator with taxes typically asks for the home’s value, the loan amount, the interest rate, the loan term, and the property tax rate. The calculator will then provide an estimated monthly payment that includes the principal, interest, and property taxes.

Property taxes are usually calculated as a percentage of the home’s assessed value, and they vary depending on the location of the property. In some areas, property taxes can be as high as 2-3% of the home’s value. Therefore, including property taxes in a mortgage calculator can provide a more accurate estimate of the monthly mortgage payments.

Most mortgage calculators with taxes are available online and are free to use. Many mortgage lenders, banks, and financial institutions offer their own mortgage calculators with taxes on their websites. Additionally, there are several third-party websites that offer mortgage calculators with taxes, such as Zillow, Bankrate, and NerdWallet.

It’s important to keep in mind that a mortgage calculator with taxes provides an estimate of the monthly payments, and actual payments may vary depending on other factors, such as homeowner’s insurance, private mortgage insurance (PMI), and home association fees. Additionally, property taxes can change over time, so it’s important to review and update the estimated monthly payments periodically.

NatWest Mortagage Calculator

NatWest is a UK-based bank that provides a range of financial services, including mortgage lending. If you are considering applying for a mortgage with NatWest, it is a good idea to use their mortgage calculator to get an estimate of how much you may be able to borrow and what your monthly payments could be.

The NatWest mortgage calculator takes into account factors such as the size of the mortgage you require, the length of the mortgage term, the interest rate, and whether you are a first-time buyer or not. It also includes an option to add property taxes and insurance costs to your monthly payment estimate.

To use the NatWest mortgage calculator, simply go to the NatWest website and navigate to the mortgage section. From there, you can select the “mortgage calculator” option and input the necessary information. The calculator will then provide you with an estimate of how much your monthly mortgage payments could be based on the information you provided.

It is important to note that the estimate provided by the NatWest mortgage calculator is only a rough guide and may not reflect the actual mortgage you are offered. The final amount you are able to borrow and the interest rate you are offered will depend on a variety of factors, including your credit score, income, and other financial circumstances.

If you are serious about applying for a mortgage with NatWest, it is recommended that you speak with a mortgage advisor to get a more accurate estimate of what your monthly payments will be and to discuss your specific financial situation.

ANZ Mortgage Calculator

ANZ is a leading bank in Australia and New Zealand that offers a range of financial products and services, including mortgages. If you’re interested in getting a mortgage with ANZ, you can use their mortgage calculator to help you estimate your potential borrowing capacity and monthly repayment amounts.

To use the ANZ mortgage calculator, simply go to the ANZ website and navigate to the mortgage section. From there, you can select the “mortgage calculator” option and input the necessary information, including:

- The loan amount you are interested in borrowing

- The loan term, or how long you would like to take to pay back the loan

- The interest rate you expect to be offered

- Whether you would like to make principal and interest repayments, or interest-only repayments

- Any other applicable fees or charges

Once you input this information, the ANZ mortgage calculator will provide you with an estimate of your monthly repayment amount, based on the loan details you entered. This can be helpful in giving you an idea of what your monthly expenses may look like if you take out a mortgage with ANZ.

It’s important to note that the estimate provided by the ANZ mortgage calculator is only an indication and may not reflect the actual mortgage you are offered. The final amount you are able to borrow and the interest rate you are offered will depend on a variety of factors, including your credit score, income, and other financial circumstances.

If you’re interested in applying for a mortgage with ANZ, it’s recommended that you speak with a mortgage specialist to get a more accurate estimate of what your monthly payments will be and to discuss your specific financial situation.

Mortgage Calculator NZ

A mortgage calculator is a tool that allows users to estimate their monthly mortgage payments based on various inputs, such as the loan amount, interest rate, and term length. This tool can be particularly helpful for potential homebuyers who are trying to determine how much they can afford to borrow and what their monthly payments would be.

In New Zealand, several banks and financial institutions offer mortgage calculators on their websites. These calculators typically require users to input their loan amount, interest rate, term length, and repayment frequency. Some calculators may also allow users to include additional costs, such as property taxes and insurance.

One popular mortgage calculator in New Zealand is offered by the ANZ bank. This calculator allows users to enter their loan details and view their monthly payments, as well as the total amount of interest they will pay over the life of the loan. Other banks and financial institutions in New Zealand that offer mortgage calculators include ASB Bank, Westpac, and Kiwibank.

When using a mortgage calculator, it’s important to remember that the results are estimates only and may not reflect the actual costs associated with a mortgage. It’s also important to consider other factors that can affect the affordability of a home, such as closing costs, home insurance, and maintenance expenses.

In addition to mortgage calculators offered by banks and financial institutions, there are also several independent online mortgage calculators available in New Zealand. These calculators can be useful for comparing mortgage options from different lenders and for getting a general sense of the costs associated with a mortgage.

HSBC Mortgage Calculator

HSBC mortgage calculator is an online tool that helps you estimate your mortgage payments. It can give you an idea of how much you can afford to borrow and what your monthly payments will be. The HSBC mortgage calculator takes into account the loan amount, interest rate, amortization period, and payment frequency to calculate your mortgage payments.

To use the HSBC mortgage calculator, you will need to provide the following information:

- Loan amount: The amount you plan to borrow from the lender.

- Interest rate: The annual interest rate on the loan.

- Amortization period: The length of time it will take to pay off the loan.

- Payment frequency: The frequency at which you will make your mortgage payments, which can be monthly, bi-weekly, or weekly.

- Start date: The date on which your mortgage payments will begin.

Once you have entered this information, the HSBC mortgage calculator will give you an estimate of your monthly mortgage payments. It will also show you how much of each payment will go towards the principal and interest, as well as the total interest you will pay over the life of the loan.

It’s important to note that the HSBC mortgage calculator is only an estimate, and your actual mortgage payments may differ based on a number of factors, such as your credit score, down payment, and the current interest rate. It’s always a good idea to speak to a mortgage specialist at HSBC or a qualified financial advisor to get a more accurate estimate of your mortgage payments.

CIBC Mortgage Calculator

The CIBC mortgage calculator is a tool provided by the Canadian Imperial Bank of Commerce (CIBC) to help individuals estimate their mortgage payments. This calculator is easy to use and requires only a few pieces of information to provide an estimate of monthly mortgage payments.

To use the CIBC mortgage calculator, you will need to provide the following information:

- Purchase price: This is the price of the property you are planning to purchase.

- Down payment: This is the amount of money you plan to pay upfront as a down payment.

- Amortization: This is the length of time (in years) it will take to pay off the mortgage.

- Interest rate: This is the annual interest rate for the mortgage.

- Payment frequency: This is the frequency at which you plan to make your mortgage payments (weekly, bi-weekly, semi-monthly, or monthly).

- Property taxes: This is the estimated annual property tax for the property.

- Heating costs: This is the estimated monthly heating cost for the property.

Once you have entered all of the required information, the calculator will provide an estimate of your monthly mortgage payment. This estimate will include the principal and interest payment, as well as an estimate of the monthly property taxes and heating costs.

It is important to note that this is only an estimate and your actual mortgage payment may differ based on a variety of factors, including changes in interest rates, property taxes, and other fees associated with the mortgage.

Conclusion

In conclusion, mortgage calculators are an essential tool for anyone looking to purchase a home or refinance an existing mortgage. They provide a quick and easy way to estimate monthly payments, total interest paid, and the overall cost of a mortgage. With so many options available online and through various banks and lenders, it’s important to find a mortgage calculator that works best for your needs and financial situation.

When using a mortgage calculator, be sure to input accurate and up-to-date information, including the loan amount, interest rate, and term length. This will ensure that you get the most accurate estimate of your monthly payments and the overall cost of the mortgage. Additionally, keep in mind that a mortgage calculator is just an estimate, and actual mortgage payments may vary based on factors such as property taxes, homeowner’s insurance, and private mortgage insurance.

Ultimately, a mortgage calculator can help you make informed decisions about your home buying or refinancing options, allowing you to plan for a financially sound future. Whether you’re a first-time homebuyer or a seasoned homeowner, a mortgage calculator is a valuable tool to have in your financial toolkit.